Legislation Update

We’ve been following three solar-related bills this session. For the most current information about any legislation, visit LegiScan.

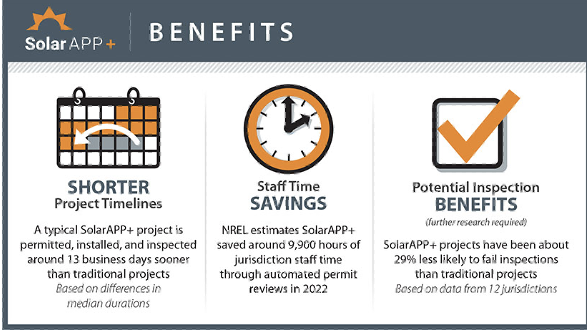

HB 3010 by Rep. Zwiener (D-45) requiring municipal/county governments to use SolarApp+ (or another online program with similar capabilities) to streamline the solar permitting process. Never had a hearing in State Affairs Committee.

HB 4455 by Rep. DeAyala (Dist 133), amends Sec. 202.010 of the Texas Property Code changing the requirement from 10% to a 25% increase in energy production if the solar energy device is located in an area not designated by the property owner’s association. Never heard in House Business and Industry Committee.

SB 2257 Sen. Cesar Blanco (Dist 29) & HB 4542 Rep. Joseph Moody (D-78) never left their committees (Senate Business and Commerce and House State Affairs respectively). The bills would have required electric utility providers (municipal utilities, co-ops, and retail electric providers) to use a net-metering buyback plan for homeowners with excess generation to interconnect to the grid.

- Authored by Schwetner and King. Currently, the bill has been placed on the Major State Calendar, and has passed out of both House and Senate committee assignments. The bill would establish a so-called “performance credit mechanism” with little regulatory oversight to help spur the construction of new dispatchable generation facilities. Estimates have pinned the cost at around $9B to taxpayers, however, the bill does have a $1B/yr annual limit which large generators have specifically indicated is not enough for them to warrant the construction of new facilities.

- Authored by Kolhorst and Middleton. Currently referred to in the House State Affairs Committee. The bill would impose extreme permitting processes for utility-scale renewable energy facilities (specifically proposed solar and wind electricity generating facilities). Unless this passes out of committee tomorrow, it is DOA.

- Authored by Perry. Currently, the bill has been placed on the Local, Consent, and Resolutions Calendars, and has passed out of both House and Senate committee assignments. The bill would direct the Texas Department of Agriculture and Texas A&M Agrilife + Forest Service to study the effects of the operation of and the impacts of the disposal of solar, wind, and energy storage equipment.

- Authored by King. Currently, the bill has been postponed, but has passed out of both House and Senate committee assignments. The bill would establish an allowance to be applied on a per-megawatt basis, to assist in covering the costs of interconnecting new dispatchable, non-renewable energy sources to the ERCOT grid, and would act as a de jure subsidy for the fossil fuel industry.

- Authored by Hughes. Currently, the bill has been sent to the Governor, where it awaits his signature. The bill would require any municipal climate charter (climate plan, action plan, vulnerability assessment, etc.), to be specifically approved by the state legislature before it can be voted on by the municipal voters and passed into municipal law. Since the Texas Legislature only meets only two years, it would significantly slow the adoption of local climate legislation. Additionally, the bill would limit the ability of municipalities, as the government closest to the people, to exercise their will, and would instead interject state politics into local issues.

- Authored by Schwertner. Currently, the bill has been placed on the Major State Calendar, and has passed out of both House and Senate committee assignments. The bill would establish a special fund for dispatchable (non-renewable) utility generators to tap to receive 2% interest loans for up to 60% of the cost of developing new dispatchable generation facilities by 2029. While the bill would not go into effect without the enabling legislation of SJR 93, it would still withhold taxpayer dollars; would provide up to 20% of costs in the form of company bonuses; and, generators have admitted that the extra financing is not necessary. Although the bill is technically meant for building any on-demand power, it excludes batteries that are typically used to store wind or solar power.

- SJR 0093 is authored by Schwertner. Currently, the bill has been placed on the Constitutional Amendments Calendar, and has passed out of both House and Senate committee assignments. The bill would serve as enabling legislation for SB 2627, another of Schwertner’s bills aimed at using taxpayer funds to subsidize the development of new natural gas powered electric generation facilities.

- Authored by Moody, and identical to Blanco’s SB 2257. Currently, the committee report was printed and distributed to the general legislature after passing out of both the House and the Senate committees to which they were referred. The bill would require areas outside of ERCOT to implement net-metering programs for solar homeowners to receive buybacks for excess electricity produced.

- Authored by Craddick, Capriglione, and Cooke. Currently, the bill has been laid on the table subject to call, having passed out of the House but not the Senate. The bill is in contrast to SB 1860. Rather than requiring approval from the politically-driven legislature, the approval of climate charters would have to come from relevant state agencies. The bill would be much more receptive to municipal charters, and would be significantly more nonpartisan.

Finally, other bills of relevance include the following:

SB 624 Kolkhorst R (D-18) imposing permitting restrictions and fines on solar and wind energy projects in the state. Engrossed on April 24 and sent to House State Affairs on May 8.

SB 114 Menendez D (D-26) requires electric companies to create residential demand response programs, creating incentives for Texans to reduce energy use during peak electric demand periods. Engrossed on May 3, referred to House State Affairs on May 6; placed on general state calendar on May 23.

SB 1699 Johnson D (D-16) provides that a retail electric provider may aggregate distributed energy resources; and (2) a person may generate electricity if the person is aggregating distributed energy resources. Placed on General State Calendar on May 22.

SB 2112 Johnson D (D-16) would accelerate the state’s reliability process by establishing the Texas Power Resiliency Fund that would provide grants to critical public safety and health facilities — such as fire and police stations, hospitals, and nursing homes — to help them develop and plug into standard VPP (or microgrid) packages. Engrossed on April 25. Referred to House State Affairs on May 4 where it was left pending.