Oct 20, 2022 | News

Source: The Eagle/Dallas Morning News

19 October 2022

Solar and wind energy saved Texans nearly $1 billion a month this year in electricity costs, according to a recent clean energy study from energy system analysis group IdeaSmiths LLC.

In the first eight months of 2022, renewables saved the Electric Reliability Council of Texas, which operates the grid, about $7.4 billion, the report shows, or about $925 million per month. Renewables are on track to save Texans $11 billion total this year.

“With a coal or natural gas power plant, you have to both build a power plant and continuously buy fuel to burn in that power plant, and so there’s higher ongoing costs,” said University of Texas Austin research scientist and IdeaSmiths executive Joshua Rhodes, who led the research. “Wind and solar generally produce very cheap electricity because they don’t have fuel costs … after you’ve built the plant there are no fuel costs associated with generating electricity.”

The report quantifies the economic benefit of renewables in terms of electricity cost, water usage and pollution. The report doesn’t address the impact of renewables on grid reliability.

Read the full article.

Oct 6, 2022 | News

What does it take to keep a preeminent, 40-year-old solar nonprofit thriving during a pandemic, extreme weather conditions and intransigent decision makers? For the past three years, Patrice ‘Pete’ Parsons has been at the helm of TXSES, carrying out the organization’s mission to educate and inspire every Texan to adopt solar energy as part of an equitable 100% clean energy future. Keeping the organization growing requires exemplary leadership and vision.

“My professional career in clean energy has prepared me for this assignment,” said Parsons. “Technologies have advanced. Consumer awareness has never been higher; demand has never been stronger. Climate change is no longer a speculation. My work at TXSES feels more urgent than ever.”

We sat down with Pete for an in-depth conversation about where TXSES has been and where it’s going.

TXSES: It’s been three years since you took over at TXSES. Where has the time gone? Your career has included work in the public, private and NGO sectors. Did that prepare you for a 40-year-old statewide solar nonprofit with regional chapters in five major metropolitan Texas cities?

PP: I’ve had a rewarding, inspiring professional career in clean energy which started back when Ann Richards was governor. I was at the General Services Commission (GSC) at the time and tasked with implementing her executive order directing all state agencies to recycle and buy recycled paper. I also worked on re-writing the Architectural and Engineering (A&E) Guidelines for state construction which included recycled building materials. I was fortunate to work on the state’s very first wind project in the Davis Mountains that would provide power to all state buildings in Austin.

After GSC, I took over the Governor’s Energy Office which I renamed to SECO, the current State Energy Conservation Office. I was focused on exploring how renewables could make an economic and environmental impact on the state. From there, I worked for the General Land Office (GLO) and Land Commissioner Garry Mauro which included representing him on President Clinton’s National Alternative Fuels Task Force and the EPA Clean Air Advisory Committee. It was a ton of fun!

TXSES: Feels like we’re only halfway to present day!

PP: After the GLO, I worked for HARC (Houston Advanced Research Center) where I started a Fuel Cell Research Center. I assembled a team of privately held companies to fund research on PEM (proton exchange membrane) fuel cells for stationary applications. From HARC, I went to ICLEI Local Governments for Sustainability as its South-Central Director to help 50 cities implement climate action, sustainability and resiliency plans. It was exciting but exhausting! That’s when Ann Hamilton, formerly with the Houston Endowment and current TXSES board member, told me about the ED opportunity with TXSES. In addition to my interest in seeing how I can make a difference in the solar arena, returning to Austin felt like the right move so I could be closer to my mom, my children and my grandchildren. So to answer the question: did my previous work prepare me for TXSES? Absolutely. So much has happened over the past 30 years. Technologies have advanced. Consumer awareness has never been higher; demand has never been stronger. Climate change is no longer a speculation. My work at TXSES feels more urgent than ever. We have no time to waste.

Pete Parsons at HARC meeting, ca 2000

TXSES: So tell us what TXSES is focusing on these days.

PP: With all that’s happening in the clean energy space, it’s easy to get overwhelmed. To respond to consumer demand for solar, we see strategic distributed solar opportunities for a more resilient grid with rooftop and community solar. There’s no drop in consumer demand; in fact, our installers tell us they need workers! In response, we jumped in to help. For the past 18 months, we’ve been focused on building an educated, quality-trained diverse solar workforce for low-income populations; we’re pleased with our progress.

TXSES: Who else is TXSES targeting with education and training?

PP: Thanks to marketing support from the Texas Electric Cooperative, we’ll be holding training for Texas rural electric coops with experts from industry, national labs, and consultants who will share their experience and knowledge about technical opportunities and challenges, funding, state and national examples of community solar, residential and commercial solar programs, how to value solar. We hosted two of these workshops for New Braunfels Utility (NBU) earlier this year which were wildly received. According to NBU, these workshops provided a wealth of information that increased its understanding of and confidence in implementing initiatives that are new to many coops.

TXSES: TXSES was involved in last year’s effort to educate homeowners in the Pedernales Electric Cooperative (PEC) service territory. How did that go?

PP: There’s good news and not-so-good news. Working with other stakeholders, we focused on organizational change at the PEC to diversify its leadership and promote clean energy programs. Our efforts included leadership diversity, a vigorous public awareness campaign for solar in PEC’s service territory and a value of solar study to quantify the costs and benefits of each solar owner’s array to PEC’s system.

We hosted several town halls to educate PEC homeowners about proposed changes to PEC’s rates for solar generation. Despite our efforts, PEC prevailed its bid to implement anti-solar policies that affect current solar homeowners and potential solar homeowners. As the largest rural electric coop in Texas AND the US, PEC’s actions are especially concerning. That said, we’re not deterred. In fact, it only fires us up to ramp up our consumer awareness efforts so PEC homeowners have fact-based information to make decisions that will impact their lives and ours as well.

TXSES: The recent passage of the Inflation Reduction Act (IRA) has substantial funding opportunities for states. In fact, we’ve not seen such a tranche of federal money for energy initiatives since ARRA (American Recovery & Reinvestment Act). What are your thoughts about this?

TXSES: It is the most significant climate legislation in US history. Modeling finds IRA’s $370B in climate and clean energy could help cut US greenhouse gas (GHG) emissions up to 43% BELOW 2005 levels by 2030…just seven years away! Reports of job growth exceed one million new jobs, affirming our work to educate and train a quality, diverse solar workforce. To capitalize on those federal dollars, Texas must pass bold clean energy targets. But with actions like appointees to the quasi-secretive State Energy Advisory Plan Committee by the governor, lieutenant governor and speaker, opportunities to realize those bold clean energy targets will be a challenge.

But the opportunities are huge. The State Energy Conservation Office (SECO) will have its hands full administering those dollars. While fossil fuels do benefit from this bill, clean energy resources like solar, wind and efficiency are the real beneficiaries of IRA. One of the really big wins: the 30% federal tax credit for rooftop solar installations now has a 10-year extension! Other consumer tax credits include energy-efficient windows, doors, electric water heaters, furnaces, electric vehicles (EV) and EV recharging equipment. Just a couple of weeks ago, SEG Solar announced it will build a 2 GW capacity solar module manufacturing plant in Houston. Construction is expected to begin at the end of this year and be operational by mid-2023. And while this was in the works before IRA, I think we’ll see more solar manufacturing facilities pop up all across the US, thanks to the IRA.

TXSES: Another reason to make sure we’ve got a strong solar workforce! But…what about the delays in permitting? This has been publicized a lot lately.

PP: Bret Biggart, Freedom Solar (and TXSES Platinum Business Member) wrote about this very issue in a recent issue of Texas Monthly. If Texas consumers want to go solar and help relieve pressure on the grid, why make it so difficult? It’s not that difficult a process, and certainly not helping consumers have a favorable view of their utility. But there’s a great tool to help alleviate this issue. Solar App+ software developed by NREL is a free online tool that completely automates the permitting process, shaving five to 10 days off the process. Solar App+ is projected to add solar to 2.4 million homes and 30,000 jobs across the US. We’re working to raise awareness of Solar App+ by Texas local governments and coops so they can deploy it.

TXSES: This was one of the hottest summers on record. We’ve not seen final numbers for August or September but 2022 ranks as one of, if not the hottest summers on record, and the likelihood that this kind of weather pattern is now the norm. How do you see TXSES responding to this over the next five years?

PP: It’s not just summer temperatures that are extreme. Remember Winter Storm Uri in February 2021? This is everyone’s conversation today. What do we do? Where do we go? How do we pivot and adjust to this new existence? Our collective response must be thoughtful, smart, common sense. We formed a policy committee for our business members to ensure we know first-hand what issues are impacting the industry. Five years is just two legislative sessions. In fact, we’re gearing up for the 86th legislative session in January which is safe to assume will have a significant energy focus. We’ll be busy doing what we do best: educating decision-makers and individuals with fact-based information about the value and benefits of solar. We can no longer limp along with an antiquated, volatile electric grid and policies that support the status quo while consumer demand for solar is off the charts. At TXSES, we’re not standing idly by, hoping our decision-makers boldly confront the issues of climate change, drought, extreme heat and cold temperatures. Consumer demand drives policies. We’re deeply committed to our decades-old work to make sure all Texans are educated about solar.

Sep 1, 2022 | News

Touted as “the single biggest climate investment in US history,” President Biden signed the historic $739 billion Inflation Reduction Act (IRA) on August 16, signaling an unprecedented level of federal support toward our transition to a clean energy economy.

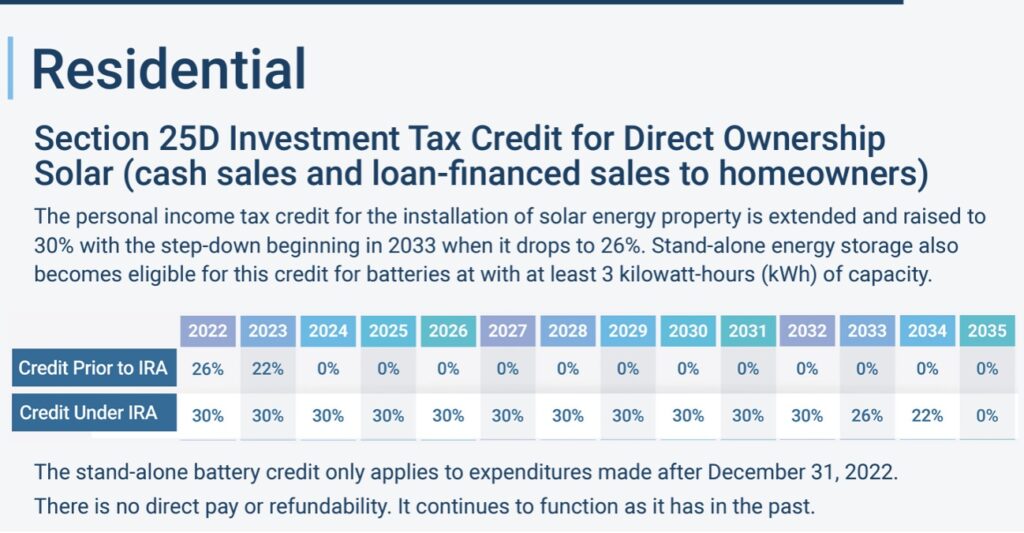

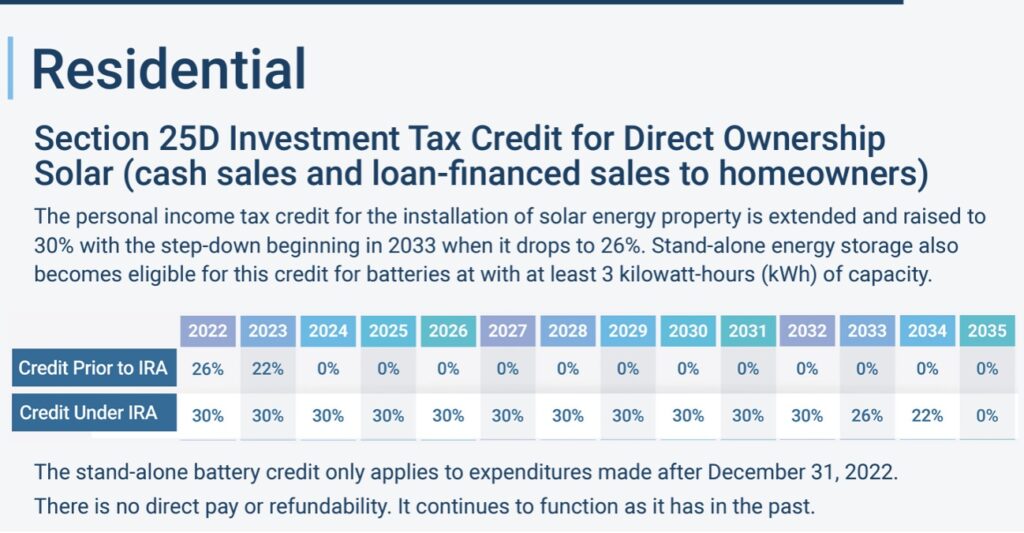

One of the more celebrated provisions in the IRA is the 10-year extension of the Investment Tax Credit (ITC) which applies to individuals like you and me. Instrumental in launching the solar industry in 2006, the ITC’s 10-year extension at 30% of the cost of the installed equipment will step down to 26% in 2033 and 22% in 2034.

As more Texans consider going solar, the opportunity for scams increases.

Our friends at Austin Energy have details on their website to avoid being scammed. Check it out!!

Aug 18, 2022 | News

The Public Utility Commission of Texas (PUCT) is developing a pilot project to investigate how distributed energy resources can boost electric reliability and deliver the proposal to ERCOT by October 11, 2022 to meet a pilot start date in Q1 2023.

ADER Pilot Projects allow ERCOT to evaluate costs and benefits of proposals without full implementation through ERCOT Protocols.

Specifically, the pilot will answer how aggregated distributed generation can support reliability, enhance the wholesale market, incentivize investment, potentially reduce transmission and distribution investments and support better load management during emergencies. The pilot is expected to run for three years.

A 20-member stakeholder committee includes four categories: transmission and distribution providers; rural electric providers; ADER providers; and technical expertise/institutions. Amy Heart, vice president of public policy at Sunrun and TXSES board member, is on the ADER providers committee.

Transmission and Distribution Service Providers

Jason Ryan, CenterPoint Energy Chair

Alejandro Ramirez, AEP

Andrew Higgins, CPS Energy

John Padalino, Bandera Electric Cooperative

Martha Henson, Oncor

Retail Electric Providers

Arushi Sharma Frank, Tesla

James McGinnis, David Energy

Michael Lee, Octopus Energy

Ned Bonskowski, Vistra

Resmi Surendran, Shell Vice Chair

ADER Providers

Amy Heart, SunRun

J. T. Thompson, Generac

Joel Yu, Enchanted Rock

John Bonnin, AutoGrid

Suzanne Bertin, Texas Advanced Energy Business Alliance (TAEBA)

Technical Expertise/Institutions

Carmen Best, Recurve

Erik Ela, Electric Power Research Institute (EPRI)

Margo Weisz, Texas Energy Poverty Research Institute (TEPRI)

Miroslav Begovic, Texas A&M University

Scott Hinson, Pecan Street

Aug 17, 2022 | News

State Energy Plan Advisory Committee Meeting Puts Renewables on the Chopping Block

On Friday, August 12, 2022, I attended the first publicly announced State Energy Plan Advisory Committee. The committee, which has met only twice since its formation in 2021, has taken no public testimony. In fact, the committee and its anti-renewable stance has finally gained public attention, thanks to good friend and colleague Doug Lewin.

The 12-member committee, appointed by Governor Abbott, Lt. Gov. Patrick and Speaker Phelan, includes representatives from the natural gas and utility industries only. Neither the solar nor wind industries are represented. Although the committee was created during the 87th Legislature in 2021, Patrick announced his four appointees in February 2022.

The committee was tasked with preparing a comprehensive state energy plan that includes methods to improve the reliability, affordability and stability of the Texas grid. Yet the committee held its second full meeting on August 8th to vote on and approve the State Energy Plan Report, to be delivered to the legislature by September 1, 2022, which begs the question: with only two meetings and no clean energy representatives on the committee, how will renewables fare in a state energy plan moving forward?

At the August 12th meeting, committee members discussed including renewables along new transmission lines to increase the amount of available intermittent renewable energies. Members agreed that renewables’ intermittency makes them an unreliable energy source; they may fluctuate too much to be stable for taxpayers.

Actually, the term isn’t intermittent; it’s variable. But thanks to improved weather predictions and operating experience, renewables have two things fossil plants don’t: they are highly predictable and have well over 95% availability. That is, renewables are there when you expect them and need them to be, outperforming other power plants that were offline or failed to meet expectations. Managing large amounts of renewables does take work, but as shown on recent hot peak demand days or during Winter Storm Uri, they overperform and can save Texans millions in costs.

After widespread blackouts during Uri, regulators approved a series of market reforms designed to avoid grid disruptions this summer — and the costs for those reforms are already showing up on our bills. In fact, Texas consumers are now paying about $0.20/kWh, about double what they were in January.

The issue isn’t whether renewable energy technologies aren’t advanced enough or Texas has an insufficient amount of them. During the first three months of 2022, wind and solar accounted for a record 34% of generation within ERCOT, outperforming the state’s fleet of combined-cycle gas turbines as the dominant source of electricity, according to a new report by the Institute for Energy Economics and Financial Analysis. And in July, solar met 10% or more of demand at the peak hour on 25 of July’s 1 days. On the other four days, solar was above 9.6% of total demand at the peak hour.

The issue is transmission.

ERCOT, our power grid, is isolated from the rest of the nation’s power grids, limiting our ability to import power when we need it and export power when we have excess. During Winter Storm Uri, we were unable to receive power from neighboring power grids. And just this summer, some West Texas wind generation went offline because of transmission constraints, depriving cities like Houston, Dallas or Austin of affordable, clean power.

With an extra $27B in state coffers for the upcoming 88th Legislature, legislators have the distinct opportunity to enact smart policies like upgrading inadequate transmission capabilities so that renewables can provide grid stability during high energy demand summers and winters at competitive prices.

Rather than imposing punitive regulatory actions on renewables, despite clear evidence of their benefit to the grid, helping Texas’ decision makers recognize the enormous benefits of renewable energy technologies so they can propose sound clean energy policies that remove barriers for a 21st Century grid is the more sensible approach.

This is what TXSES does best.

For more than four decades, TXSES has been the pre-eminent statewide organization that develops independent, fact-based solar energy information and brings them to leaders in communities like yours, enabling them to make the best decisions that inspire innovation and lay the foundation for a 100% clean energy future for us all, one community at a time.

Aug 16, 2022 | News

Touted as “the single biggest climate investment in US history,” President Biden signed the historic $739 billion Inflation Reduction Act (IRA) on August 16, an unprecedented level of federal support toward our transition to a clean energy economy.

Credit: whitehouse.gov

Referred to as “Energy Security and Climate Change,” investments aimed at reducing CO2 emissions below 2005 levels by 40% by 2030, account for $369 billion or about 50% of the bill’s overall funding.

One of the more celebrated provisions in the IRA is the 10-year extension of the Investment Tax Credit (ITC) which applies to individuals like you and me. Instrumental in launching the solar industry, the ITC’s 10-year extension at 30% of the cost of the installed equipment will step down to 26% in 2033 and 22% in 2034. Here’s what the tax credit looks like before and after the 10-year extension:

Pre-IRA ITC: (assume $18K system and $1K utility rebate)

0.26 * ($18,000 – $1,000) = $4,420 tax credit

IRA ITC: 0.30* ($18,000 – $1,000) = $5,100 tax credit

Source: SEIA

The 30% credit also applies to energy storage whether it is co-located or installed as a standalone. This enables the retrofit of a battery to a solar array while taking advantage of the credit.

Tax credits will fund the purchase of heat pumps, rooftop solar systems, electric HVAC systems and electric water heaters. Transportation tax credits include $4,000 to eligible low-to-moderate income individuals to buy used clean energy vehicles, or $7,500 for new clean energy vehicles. Energy efficiency in new affordable housing projects will receive $1 billion. Consumer home rebate programs for low-income individuals will offer up to $9 billion for appliance electrification and energy efficiency retrofits.

Another notable element in the IRA is the clean manufacturing program. Designed to last a decade, this facet will enable companies to scale up and increase production volume and efficiency, supporting development across the clean energy supply chain.

Known as the 45X Advanced Manufacturing Production Tax Credit (PTC), named after the section of the tax code it would alter, this production credit would direct roughly $30 billion over the next 10 years to support the production of components of solar panels, wind turbines, inverters and batteries for electric vehicles and the power grid, as well as promote mining and refining the critical minerals that go into these products. The other half of the $60 billion clean energy manufacturing money consists of $10 billion in new investment tax credits and $20 billion in loans for clean vehicle manufacturing.

In addition:

- National laboratories: $2 billion for clean energy research;

- The Defense Production Act: $500 million for affected companies to manufacture heat pumps and process needed mineral materials;

- $30 billion in targeted grant and loan programs for state energy offices and electric utilities to incentivize the transition away from fossil fuels;

- Advanced Industrial Facilities Deployment Program with $6 billion will cut CO2 output in chemical, steel and cement manufacturing facilities;

- $9 billion for the federal government to buy clean energy technologies, $3 million of which will go USPS for ZEVs (zero emission vehicles);

- Clean Energy Technology Accelerator program will fund $27 billion for emission-reduction technologies in targeted low-income communities.

To ensure that the act targets historically disadvantaged communities and avoids the pitfalls of environmental racism, bill authors coordinated with environmental justice leadership, shoring up $60 billion for programs including $3 billion in environmental and climate justice block grants; $3 billion in neighborhood access and equity grants; $3 billion in grants to reduce air pollution at ports; $1 billion towards the procurement of no-emission freight and public transportation; and various bonuses and set-asides within tax credits that incentivize their use in low-income communities.