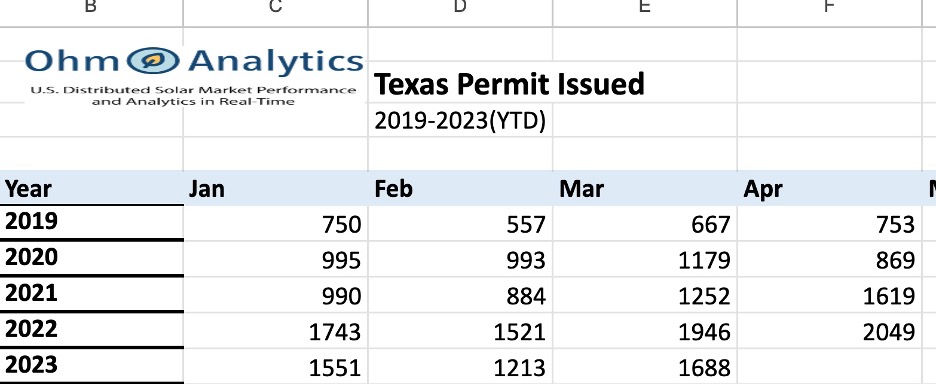

Platinum Business Member Ohm Analytics recently shared select data for Texas permits issued for distributed solar installations for 2022-Q1 2023.

Tracking market volume, growth, pricing and equipment trends in over 50 major metro areas in the U.S., Ohm Analytics’ platform aggregates a proprietary database of solar projects in the U.S. based on permit and interconnection data.

According to Ohm, Q1 2023 was characterized by a marked downturn in annualized growth across most southern markets, including key solar states Arizona, Florida, Nevada and Texas.

“The 12% decline is a result of an uncertain macro-economic environment coupled with tightening credit markets,” said Joseph Wyer, Clean Energy and Policy Analyst, Ohm Analytics. “This has really impacted the value of solar in low-cost energy states like Texas,” he said.

Texas cities that have experienced the greatest reduction in residential building permits are: Grand Prairie (-53%); Arlington (-37%); Mesquite (-36%); Houston (-22%); and San Antonio (-20%). To accommodate this fluid environment, sales organizations shifted their focus on higher growth markets in the northeast where despite an increase in consumer’s monthly system payments, those costs are still well below a consumer’s monthly utility costs.

What’s the outlook for the remainder of 2023?

“Credit impacts, like higher interest rates, increased dealer and installer fees, will continue to create headwinds through 2023,” said Wyer. Rising utility rates and adoption of third-party ownership as an alternative to financing will help drive a partial recovery.

Looking ahead to 2024, Ohm Analytics still sees strong fundamentals in the Texas market for long-term growth based on consumer demand for resiliency amidst a backdrop of rising utility rates.

Ohm Analytics will share these data quarterly.