Touted as “the single biggest climate investment in US history,” President Biden signed the historic $739 billion Inflation Reduction Act (IRA) on August 16, an unprecedented level of federal support toward our transition to a clean energy economy.

Referred to as “Energy Security and Climate Change,” investments aimed at reducing CO2 emissions below 2005 levels by 40% by 2030, account for $369 billion or about 50% of the bill’s overall funding.

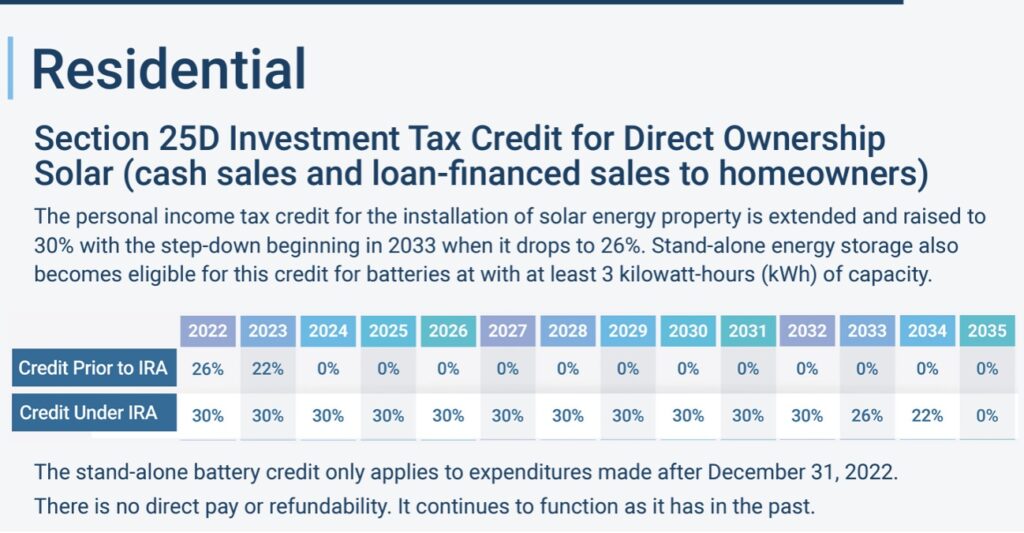

One of the more celebrated provisions in the IRA is the 10-year extension of the Investment Tax Credit (ITC) which applies to individuals like you and me. Instrumental in launching the solar industry, the ITC’s 10-year extension at 30% of the cost of the installed equipment will step down to 26% in 2033 and 22% in 2034. Here’s what the tax credit looks like before and after the 10-year extension:

Pre-IRA ITC: (assume $18K system and $1K utility rebate)

0.26 * ($18,000 – $1,000) = $4,420 tax credit

IRA ITC: 0.30* ($18,000 – $1,000) = $5,100 tax credit

Source: SEIA

The 30% credit also applies to energy storage whether it is co-located or installed as a standalone. This enables the retrofit of a battery to a solar array while taking advantage of the credit.

Tax credits will fund the purchase of heat pumps, rooftop solar systems, electric HVAC systems and electric water heaters. Transportation tax credits include $4,000 to eligible low-to-moderate income individuals to buy used clean energy vehicles, or $7,500 for new clean energy vehicles. Energy efficiency in new affordable housing projects will receive $1 billion. Consumer home rebate programs for low-income individuals will offer up to $9 billion for appliance electrification and energy efficiency retrofits.

Another notable element in the IRA is the clean manufacturing program. Designed to last a decade, this facet will enable companies to scale up and increase production volume and efficiency, supporting development across the clean energy supply chain.

Known as the 45X Advanced Manufacturing Production Tax Credit (PTC), named after the section of the tax code it would alter, this production credit would direct roughly $30 billion over the next 10 years to support the production of components of solar panels, wind turbines, inverters and batteries for electric vehicles and the power grid, as well as promote mining and refining the critical minerals that go into these products. The other half of the $60 billion clean energy manufacturing money consists of $10 billion in new investment tax credits and $20 billion in loans for clean vehicle manufacturing.

In addition:

- National laboratories: $2 billion for clean energy research;

- The Defense Production Act: $500 million for affected companies to manufacture heat pumps and process needed mineral materials;

- $30 billion in targeted grant and loan programs for state energy offices and electric utilities to incentivize the transition away from fossil fuels;

- Advanced Industrial Facilities Deployment Program with $6 billion will cut CO2 output in chemical, steel and cement manufacturing facilities;

- $9 billion for the federal government to buy clean energy technologies, $3 million of which will go USPS for ZEVs (zero emission vehicles);

- Clean Energy Technology Accelerator program will fund $27 billion for emission-reduction technologies in targeted low-income communities.

To ensure that the act targets historically disadvantaged communities and avoids the pitfalls of environmental racism, bill authors coordinated with environmental justice leadership, shoring up $60 billion for programs including $3 billion in environmental and climate justice block grants; $3 billion in neighborhood access and equity grants; $3 billion in grants to reduce air pollution at ports; $1 billion towards the procurement of no-emission freight and public transportation; and various bonuses and set-asides within tax credits that incentivize their use in low-income communities.