by Ethan Miller

According to a new study commissioned by the Texas Solar Energy Society and produced by Dunsky Energy and Climate Advisors, the value of solar (VOS) is experiencing externalities.

Externalities, according to the International Monetary Fund, are a market failure that occurs when a good’s “indirect effects have an impact on the consumption and production opportunities of others, but the price of the product does not take those externalities into account.” Put simply, it’s when a good’s price doesn’t reflect its true value.

Externalities are either negative (when a cost is not reflected in the price) or positive (when a benefit is not reflected in the price). Both positive and negative externalities result in market inefficiencies. If the externality is negative, producers overproduce the good (shifting unaccounted costs to consumers), and if positive, producers underproduce the good (shifting unaccounted for benefits to consumers).

In Texas, solar displays positive externalities. Distributed solar producers aren’t being paid for the full dollar value of the kWh(s) they put out, so Texas produces less solar than we could/should be. It’s unclear what the full impact of the externality is on the state’s economy, but we have approximated the difference between what solar owners are paid, and what they should be paid.

First, some background on the Dunsky-commissioned study. Dunsky estimated the “distributed solar PV’s generation, delivery, and societal value across the Deregulated market within the Electric Reliability Council of Texas (ERCOT) territory”. Basing their study on a set of assumptions (including the typical energy output for a system, typical losses associated with shade or dust, etc.) and comparing them to other VOS studies, Dunsky undertook a three-step process. First, they identified best-practices and assumptions from similar studies. Then they adjusted variables specific to Texas. Finally, they quantified the value of solar using an avoided-cost approach, which is the minimum value that utilities would need to pay solar owners based on the value difference between purchasing energy from the solar owner compared to purchasing the energy from another source, or generating the electricity with the utility’s own generators. Based on their model, Dunsky estimates the value of solar between 2025 and 2050 to average $0.24/kWh (2024 USD).

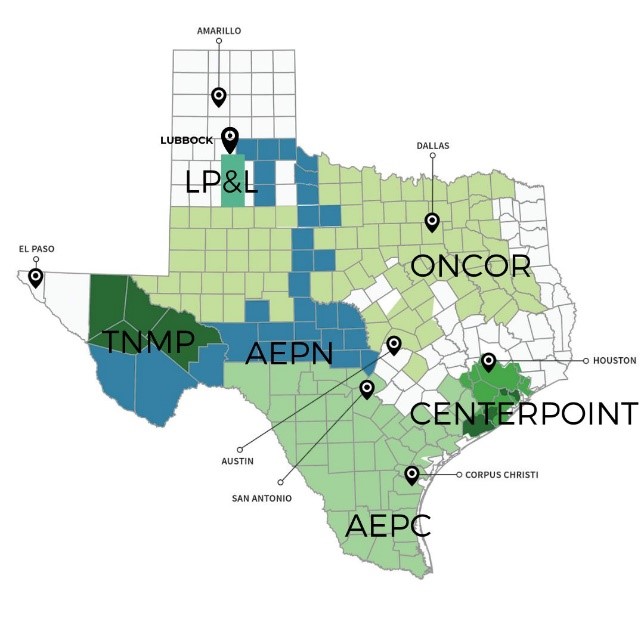

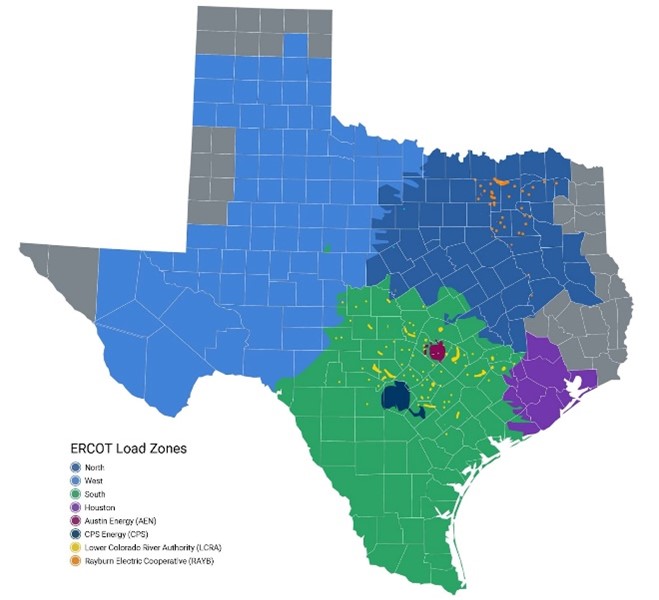

Unfortunately, there’s no available estimate of the typical solar buyback (payment plan) rate across Texas. That’s in part thanks to differing pricing mechanisms and unique details associated with each buyback plan. Fortunately, Quick Energy maintains a list of retail electric providers (private electric utilities in Texas’ deregulated markets) in Texas that offer buyback plans. By calculating the mean of average kWh prices paid to solar owners at an assumed 1000 kWh output, the typical solar owner in the Oncor transmission and distribution utility (the deregulated market in Texas centered around Dallas, where the power lines are owned and operated by Oncor) service area, is paid roughly $0.17/kWh (2024 USD). The next challenge is that the Dunsky study, unlike Quick Energy’s average buyback plans, are not based on TDU service areas, but ERCOT Load Zones (regions of the state where electric buses are parked to monitor changing electricity prices). Luckily, the North Load Zone aligns fairly close with the Oncor service area around the Dallas/North Texas region. While far from a perfect comparison, it’s an assumption based on limited information.

For 2025, Dunsky estimates the value of solar in the North Load Zone at $0.32/kWh (fairly close to other state’s estimates, such as Maine’s estimate of $0.35/kWh). Assuming a 3% rate of inflation from 2024 to 2025, Oncor’s $0.17/kWh rises to $0.18/kWh (2024 USD) in 2025. Therefore, taking the difference between $0.32/kWh and $0.18/kWh gives us the difference between the current value and the true value of solar – $0.14/kWh in 2025 (2024 USD), 78% greater than their current typical buyback rate.

There are further assumptions however that impact these numbers. The majority of retail electric providers (private utilities) have no solar buyback plan at all. The ‘typical’ solar owner may be earning much less because this back-of-envelope calculation doesn’t include those utilities without plans. Further, Quick Energy’s estimates rely on their own set of assumptions. Only one utility in the Oncor TDU pays even close to the true VOS. Chariot’s 2024 Rise 36 plan was estimated by Quick Energy to pay $0.25/kWh ($0.26/kWh in 2025), meaning it would still be $0.06/kWh away from the true VOS. Additionally, the true Rise 36 rate is more complicated than the average. The actual plan pays $0.17/kWh (retail rate) minus transmission fees but is only available to solar owners who “generate less energy than what they use, on average.”

Regardless of the intricacies of generalizing across many specific buyback plans, one thing is for certain. Texas solar owners are getting paid significantly less than what they’re worth (around 14 cents per kWh to be exact), and that’s bad for the economy and the energy industry alike. In fact, Texas is one of only two states in the country with no statewide buyback plan for solar (whether that be net metering, the method of solar valuation historically favored by solar owners, or some other value structure). In Native Solar’s words, “the lack of official state net metering policies, paired with Texas’ peculiar electricity market, makes it somewhat difficult for solar owners to navigate what solar buyback options are available to them”. If Texas wants to maintain its place in the top 10 of distributed-solar-producing states, it will have to address the underpayment of solar owners, sooner, rather than later.

——————-

Note: Maps sourced from Quick Energy and ERCOT.

Disclosure: Native Solar is a Silver Business Member of the Texas Solar Energy Society but played no part in the writing of this newsletter.