By Ron Zagarri, North Texas Renewable Energy Group (NTREG)

June 2020

Pssst! I have a great investment opportunity for you. How would you like to get in on the ground floor of my new business? The business is capital intensive; we need to build huge factories to make our product. The product also requires significant recurring investments to keep current with our competitors – we have a lot of them – who make essentially the same product that they constantly improve. Oh yes, we also need to continually cut our prices because those annoying competitors keep lowering theirs. Interested? Hello? Anybody?

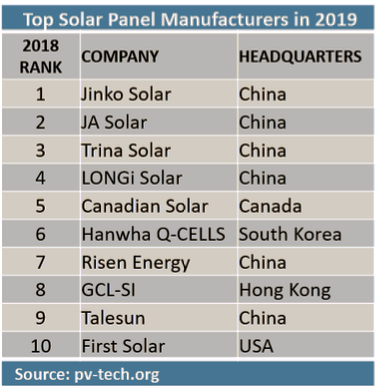

If you thought this was a crazy investment premise, you would be in good company. Yet, this is precisely what is occurring in solar module manufacturing. China has cornered the bulk of the market with secular investments in massive factories that serve global demand. Dominated by a dozen or so vertically integrated goliaths, they watch the price per watt of their solar modules decline year after year.

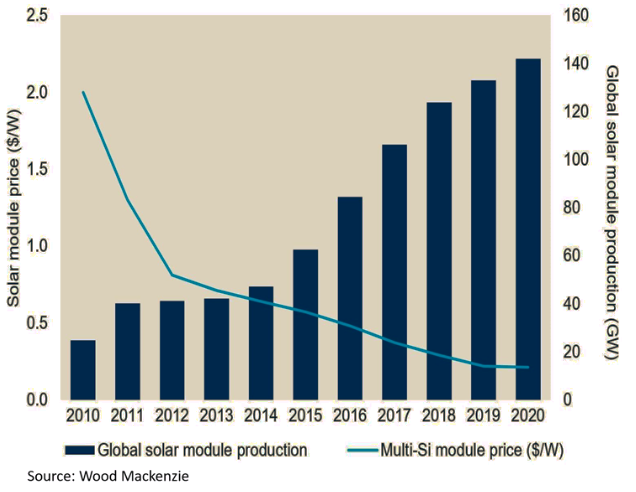

Lucky for us, price drops are not a recent phenomenon; they are down 99 percent in the last four decades. Modules cost $2 per watt in 2010, dropping to 18 cents today. In this past decade, while no other power generation technology could match this cost reduction pace, annual solar installations grew more than six-fold globally.

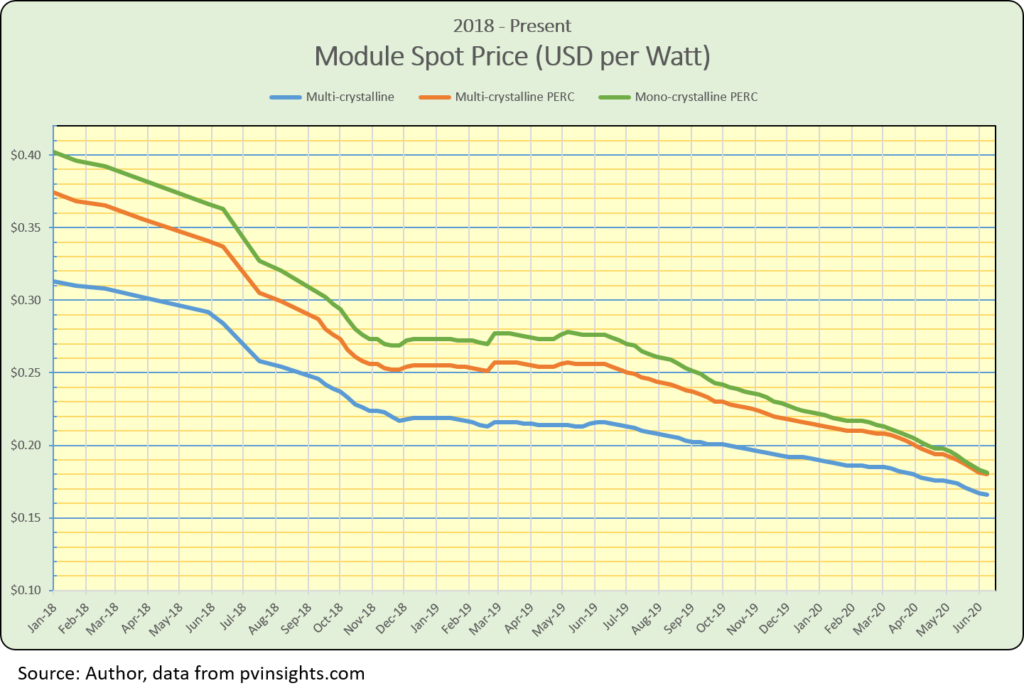

Let me emphasize that these are spot prices – the initial cost of a solar module at the factory gate. The wholesale cost of a module purchased in the United States is significantly higher due to tariffs, shipping, and other distribution levies. Spot prices are an important, closely watched indicator and U.S. prices inevitably follow spot price trends.

What exactly is the fundamental cause of these stunning price declines? While a major success story for renewable energy, the reasons remain elusive. One wonders if the big solar module makers are just not interested in turning a profit. Have they fixed their altruistic attention exclusively to saving the planet with inexhaustible, clean solar energy at thinner and thinner margins? Call me a cynic, but I do not believe that is happening, and the answer lies elsewhere.

Technology and Scale

With questions like this, it is always best to examine the role of technology for the answer. Creative new production techniques and technology breakthroughs often disrupt time-honored, incumbent manufacturing paradigms. Have we seen such a technological step change in solar modules in the last forty years?

Not really.

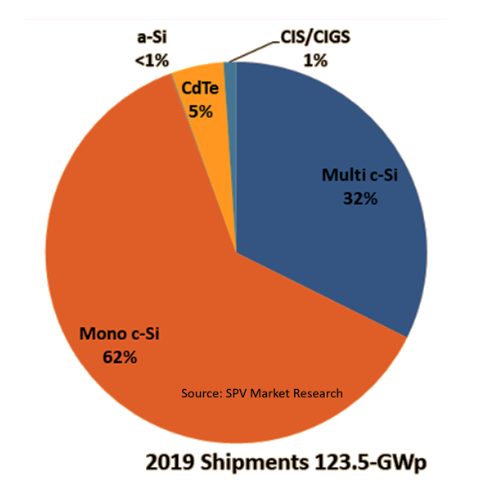

Crystalline silicon (c-Si) remains the dominant chemistry that accounts for a whopping 94 percent of the global market. A factory worker just awakening from a twenty-year coma would not observe much different in the various process steps leading from raw material to finished product today. The factory manager would welcome her back to her old job and she would quickly become a productive employee again.

There certainly have been incremental improvements in solar cell and panel efficiency, squeezing more electricity out of available sunlight. These slow and gradual refinements, also fueled by the power of Swanson’s Law, add up over time and enable lower prices. Yet, these factors account for only a portion of the module-level cost savings the industry has realized.

Others have posed this same question and examined the technology-level (“low-level”) factors that affect cost. While these bottom-up scholarly analyses are informative, low-level mechanisms dealing with the physical products themselves often miss the bigger picture shaped by economics and psychology.

Competition and Market Share

As the graph above illustrates, the cost of high-efficiency mono-crystalline PERC modules is converging to the cost of lower-efficiency module types like multi-crystalline and multi-crystalline PERC. (You are probably sorry you asked, but PERC stands for passivated emitter, rear contact, a process step that improves a solar cell’s efficiency.) A transition decades in the making, mono-crystalline has become the dominant module type over multi-crystalline, triggering a price war for market share.

Contention among the major Chinese manufacturers to be Number One and not be left behind in the capacity to produce the most popular types of modules spawns a persistent state of oversupply. The Chinese corporate chieftains, supported and encouraged by the central government, place great value in owning the largest factories, operating production lines at high throughput, and keeping employment levels elevated. This robust mass production, in excess of even the most optimistic forecasts of likely demand for the next few years, positions the fortunate buyer to demand ever-lower prices.

Meanwhile, the pandemic is a highly visible, recent market factor suppressing global demand. Rising module inventories have reinforced concerns of a slowdown in solar project activity, at least through the end of this year. Nonetheless, some Chinese producers appear ready to resume capacity expansions, as the feeling predominates that the coronavirus outbreak in China is contained.

Economics 101 – good old supply and demand – suggests that as long as manufacturers continue to over-expand and over-produce, competing for a greater share of the global market and far outpacing the market’s appetite for more solar, prices will continue on a downward trajectory. The longer this supply/demand imbalance persists, and the more time Swanson’s Law works its magic, the further solar will consolidate its position as our dominant new energy source, and the more we will witness the relentless retirements of coal and gas power plants.

How Low Can Module Prices Go?

Making cost predictions over any timeframe is a dicey game, but using the past decade as a handy portent ($2 to 18 cents), in several years we could be celebrating the spot price of solar modules falling to a nickel per watt. Oh Happy Day.

There are no inherent limits to further reductions. The industry has captured only a portion of the ultimate efficiency of c-Si solar cells, the Shockley–Queisser limit. The fixed cost of solar technology will continue to follow its version of the Moore’s Law of integrated circuits down the cost curve while forever coupled with the near-zero marginal cost of energy from the sun.

We have come such a long way to a point where it is difficult to imagine a world in which these stark economic factors could somehow fail to drive the global proliferation of ever-more renewable energy.

Ron Zagarri serves on the board of the North Texas Renewable Energy Group (NTREG) and is the past vice-chair of the Texas Solar Energy Society. He continues to volunteer with TXSES on financial and accounting matters.