By Joshua D. Rhodes, Ph.D. , Research Associate, Webber Energy Group University of Texas/Austin

There is not much in this world that has not been touched by this pandemic. Most news feeds and social media streams seem to be about the same thing: COVID, COVID and more COVID. But then again, it has touched all aspects of our lives from how we eat, to how we meet and where we put up our feet. Its impact is also being felt in the solar industry.

A recent survey by the Global Solar Council of hundreds of solar companies in dozens of countries found that more than 70% of solar companies have experienced slowdowns and about 80% expect more slowdowns in the next four months. The main reasons include supply chain interruptions, labor issues and clients being more cautious. In some regions, rooftop PV was not seen to be an “essential service” and thus was stopped altogether.

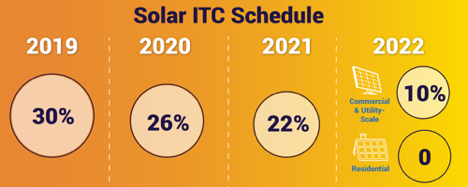

Here at home, this is a particularly challenging time for solar deployments as we are in the middle of a phase out of the Investment Tax Credit (ITC) in 2021. The rules are different for large, utility-scale and residential projects.

For example, if a utility-scale project started construction in 2019, it can – as long as construction is complete by 2024 – claim the full 30% ITC. However, residential projects are given credits based on their completion date. If the slowdown pushes a homeowner’s installation from 2020 to 2021, they receive 4% less of a tax credit. If the project is pushed out to 2022, they get zero tax credit.

There has been some discussion at the federal level about tax credit extensions for renewable energy projects, but these are likely to be most helpful to wind, perhaps retroactive, and more focused on large scale projects.

Update: the US Treasury has extended the tax credit deadline for projects to 2021, which should give developers more time to complete their projects.

COVID19 has also impacted how we use electricity. Total electricity usage is down across most of the world, including the U.S., but it is not equal across all sectors.

Industrial and commercial usage is generally down, but residential usage is up and looking different. Lower overall electricity usage could drive down wholesale electricity market prices making it less attractive to build new power plants of any type. However, solar often being the lowest cost resource, might fare better.

All of our energy systems are interrelated and connected. You can’t talk about one without talking about the others as well. The current one-two punch in the global oil markets from COVID19-driven reduced demand (i.e., we’re not traveling) and the Saudi-Russia price war has driven down the price of oil to record lows. Prices have been low before, but this time is different.

Over the past decade, the U.S. has become a major oil producer again. As low prices impact the economy, U.S. firms feel the pain. Additionally, a major portion of our domestic natural gas production is associated with oil extraction.

If we stop extracting oil, the supply of natural gas could fall, raising its price. If the price of natural gas rises, this will push up the cost of electricity because we still get almost 40% of our electricity from natural gas.

That said, if electricity prices rise, solar’s low cost will make it look even better, but this also holds true for coal. While natural gas has done the lion’s share of killing coal, higher prices could slow its march.

Most people who can have been working from home, and this has changed how we are using electricity. Most companies have been forced to put in place the infrastructure to allow their employees to work from home, even if they were previously resistant to it.

It is yet to be determined how many people will continue to work from home as a result of COVID-19, but assuming more of us will, it will be instructive to watch electricity prices, consumption and solar trends.

Joshua D. Rhodes, Ph.D. is Research Associate, Webber Energy Group University of Texas/Austin, Founding Partner, IdeaSmiths LLC and TXSES Board Member